While there are still many right-wing networks that deny the truth to global warming – or increasingly admit the world is warming but suggest that humans have nothing to do with this (a hard thing to argue as the only thing that has changed is us and our carbon emissions- and the change is happening faster than anything we can find in the last few million years), fossil fuel companies do not seem to be making the Investments necessary to move their business in the timescale available.

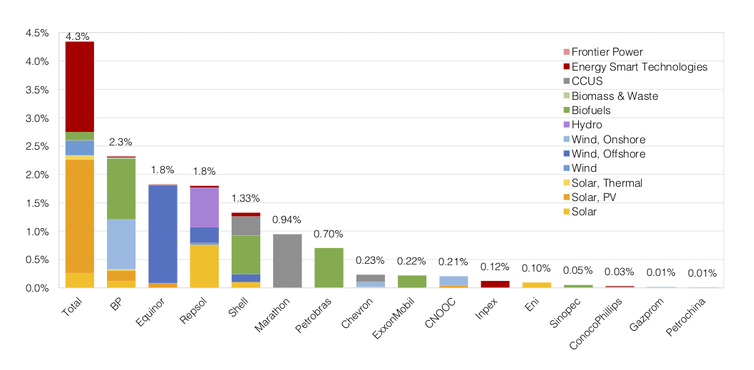

As you can see it is a pretty disappointing amount. Given that the rest of the investments (more than 95%) are large and will take a few years to start bearing fruit, there is little time for money to be made from them .It seems utterly insane to invest money in digging an oil well when it is highly likely that the price of oil will have collapsed by the time the aisle hits the market – it suggests that these oil companies are banking on being able to sell their fossil fuels long after the dates set out for the end. Should we be expecting large number of suits as it becomes clear that governments were serious? Possibly, but I think they are foolish – I believe that if any countries laws leave space for a suit on this, then the law needs rewriting. The population of the world is increasingly clear that they do not want to suffer the consequences of run-away global warming.

As an aside, it is often the people who ignore sensible moves done for their own benefit (and their descendants), who will be hit hardest by the effects of climate change.

Even hedging their bets, the oil companies are making a huge risk. By investing for 4.3% or less in renewables they are assuming that they will continue to make money from other sources (or that in the future their income is going to be at least 95.7% lower than currently). This does not look like hedging ones investments to me – fossil fuel divestments has not taken off. It is likely to hit the finances of many governments around the world, if fossil fuel use falls fast enough for us to avoid catastrophe – then they will loose billions, this strikes me as hedging in the wrong direction, they will loose if we succeed or if we fail.

What does this mean? Do we think that humanity will move away from fossil fuels as slowly as these companies would like (and accept the horrendous effect of this move), or do we think that take-up of things like renewables and electric cars will follow the standard s curve and and therefore fossil fuels will not be needed for for many areas much sooner than the all companies are expecting?

Last year in the UK 11.6% of cars sold were electric. Now, as the average length of time the British population keep that a car has increased to a little over 8 years, roughly 1.5% of the cars in the UK last year became electric. Some of these will have replaced broken electric cars but the majority will be new. It is suggested that once 10% of the British cars have gone electric this will harbour horrific impacts on on petrol and diesel markets. It would be easy to argue that at 1.5%, it is probably going to take until 2027 or 2028 just to reach 10%.

Given that more than half of young drivers (those aged between 16 and 49) intend for the next car to be electric, it is likely to accelerate dramatically in the coming years.

Given all this, I believe that there are a number of conclusions to be drawn

- A large number of fossil fuel companies are going to go out of business in the next two or three decades (likely earlier than later)

- A significant number of car manufacturers will also go out of business as they have not moved towards electric cars quickly enough.

There are of course other issues. If fossil fuel companies go out of business because they can’t sell enough of their fuels, we may suddenly find that there isn’t enough gas for the few uses that still remain. In the UK as elsewhere, 1 unit of gas is roughly a third of the same amount of electricity – as a result replacing gas boiler with electric boilers will be extremely expensive, so heat pumps are likely to only become more important.